Unlocking Business Growth: Understanding the ROI of MYOB Acumatica Cloud ERP

In today’s uncertain business landscape, New Zealand organisations increasingly turn to cloud-based ERP solutions to streamline operations, reduce costs, and drive growth. Among the leading options, MYOB Acumatica stands out as a powerful, scalable, and cost-effective solution tailored to the needs of Kiwi businesses. In fact, iStart has identified MYOB Acumatica as the number 1 chosen ERP for Australian and New Zealand businesses in 2024-25. But how do you measure the return on investment (ROI) when considering a cloud ERP implementation? Let’s explore the process and the value it can unlock in your business.

Why Cloud ERP? The Case for MYOB Acumatica

Cloud ERP systems like MYOB Acumatica offer many benefits, from operational efficiency to improved compliance and scalability. For New Zealand businesses, the ability to access real-time data, automate workflows, and integrate seamlessly with other systems is a game-changer. But beyond these operational advantages, the financial benefits are equally compelling. Understanding the ROI process helps businesses make informed decisions and justify the investment.

The ROI Process: A Step-by-Step Guide

Step 1: Identify Costs

The first step in calculating ROI is identifying all costs associated with implementing a cloud ERP system. These typically include:

- Software subscription fees: Ongoing costs for accessing the ERP platform.

- Implementation and customisation: One-time costs for setting up the system to meet your business needs.

- Data migration and integration: Expenses related to transferring existing data and integrating the ERP with other tools.

- Training costs: Investment in upskilling your team to use the new system effectively.

- Ongoing support and maintenance: Annual costs for technical support and system updates.

By understanding these costs, businesses can create a clear picture of the initial and recurring financial outlay required.

Step 2: Identify Benefits

Next, businesses need to quantify the benefits they expect to gain from the ERP implementation. These benefits typically fall into four categories:

- Operational Efficiency Gains

- Automation of manual processes reduces time spent on repetitive tasks.

- Real-time data access improves collaboration and decision-making across departments.

- Accurate inventory reporting, demand forecasting, and lead time management enhance inventory control and frees up working capital.

- Fewer errors and less rework lead to smoother operations.

- Cost Savings

- Reduced IT infrastructure and maintenance costs, as cloud ERP eliminates the need for on-premise hardware.

- Lower labour costs due to automation and streamlined workflows, which eliminate double handling.

- Savings on paperwork and manual reporting processes.

- Revenue Growth

- Faster order processing and fulfilment enhance customer satisfaction and retention.

- Improved inventory and resource management prevent stockouts and overstocking, ensuring optimal sales opportunities.

- Advanced analytics provide insights that drive better business decisions and revenue growth.

- Risk Reduction and Compliance

- Enhanced data security and compliance with industry regulations reduce the risk of fines and reputational damage.

- Consistent enforcement of company policies and governance improves overall risk management.

By quantifying these benefits, businesses can estimate the annual savings and revenue gains the ERP system will deliver.

Step 3: Calculate ROI

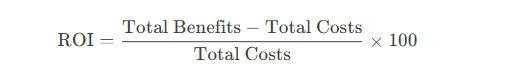

Once the costs and benefits are identified, the ROI can be calculated using the following formula:

This formula provides a percentage that represents the return on the investment. A positive ROI indicates that the benefits outweigh the costs, making the investment financially viable.

Step 4: Determine the Payback Period

The payback period is the time it takes for the benefits of the ERP system to cover the initial investment. It’s calculated by dividing the total implementation costs by the annual savings. A shorter payback period means the investment is recovered quickly, reducing financial risk.

Step 5: Conduct Sensitivity Analysis

Finally, businesses should perform a sensitivity analysis to account for different scenarios. This involves evaluating the ROI and payback period under best-case, expected, and worst-case conditions. This step ensures that the investment remains viable even if some assumptions change.

Why MYOB Acumatica Stands Out

While the ROI process is universal, MYOB Acumatica offers unique advantages that make it an ideal choice for New Zealand businesses:

- Scalability: The system grows with your business, ensuring long-term value.

- Local Support: MYOB Acumatica is tailored for businesses in New Zealand and Australia and supported by industry leading partners like Acclaim Group, ensuring timely and reliable assistance.

- Customisation: The modular design allows businesses to pay only for the features they need, optimising costs.

- Sustainability: As a cloud-based solution, MYOB Acumatica helps reduce your environmental footprint, aligning with New Zealand’s sustainability goals.

Conclusion: A Smart Investment for Kiwi Businesses

Understanding the ROI process is key to making informed decisions about cloud ERP implementation. MYOB Acumatica not only delivers significant operational and financial benefits but also aligns with the unique needs of New Zealand businesses. By streamlining operations, reducing costs, and driving growth, it’s a solution that pays for itself in both the short and long term.

If you’re ready to optimise your business, MYOB Acumatica is the cloud ERP solution that delivers measurable value. The question isn’t whether you can afford to implement it—it’s whether you can afford not to.

Need assistance to calculate if a move to a cloud ERP is right for you?

Why not get in touch, we’re always ready to catch up for a chat to see how our solutions can fit with your business.

Acclaim Group

Contact Details

Unit 4, 6-8 Omega Street

Albany, Auckland

Phone: +64 9 415 0984

Email: sales@acclaimgroup.co.nz